Moore Financial Solutions 1st Quarter 2025

About thirteen years ago when I started my career as a Financial Services Professional, I was almost instantly astute to the number one factor that determines client success. Of course, this determination was solely my own opinion. I’ve never turned on CNBC and heard scientific data backing it and likely never will. You can nearly ignore researching passive management vs. active management, throw out a comparison of exchange traded funds vs. mutual funds, and forget all about whether a Roth IRA or Traditional IRA suits you best. I believe the number one determinate of success that a client must have is “Proper Expectations”. It is by no coincidence that I believe Moore Financial Solutions clients have extremely reasonable, and ultimately the proper, expectations regarding investing. Investing long term is no casino, rather a patient approach to creating current income and future earnings. Prior to gaining licensure to be on your side financially, I know people that panicked and sold their entire portfolio and moved to cash positions in the Great Recession of 2008-09. They told the story years later to me regarding the vast missed opportunity and harm in locking in the losses. Imagine an investor panicking in Q1 of 2009 and selling stocks below 700 on the S&P 500, an index that is about eight times higher today at 5,635 (1). The S&P 500 would see gains of over 75% in the eleven months to follow, peaking this client’s FOMO and desire to get back into the market, only to sharply drop 16% over the next two months (2). My advice to you, and the number one way I can help you with your investment success, continue not being like this example investor. But rather, stay rooted in your investment philosophy.

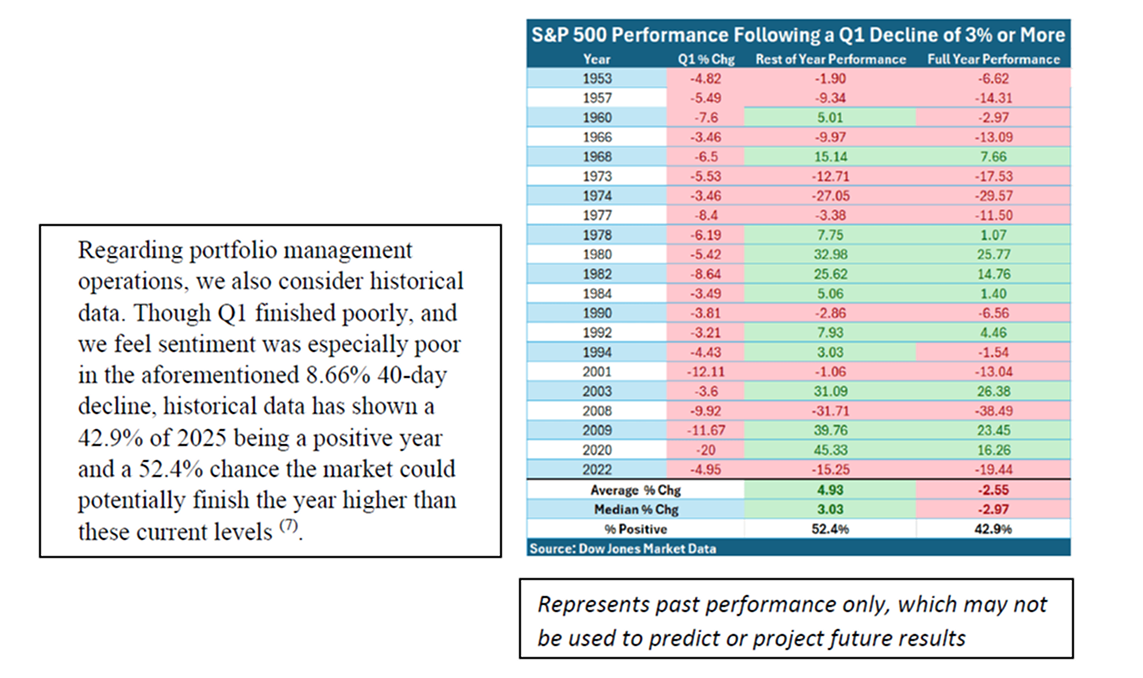

Realistically, the stages of someone’s investment life are humorous. We typically have little money early on, and it is easy to overcome the emotional impact from the money movement (a 10% decline in a portfolio of $2,500 might equate to a couple days’ earnings). But the problem is, there aren’t ample funds in that portfolio to provide life-changing growth either. For example, last year’s approximately 25% increase in a hypothetical S&P 500 index would have added only $500 to that portfolio. You want to play in the big leagues? Think you can handle the emotional impact of stocks and bonds? Try having an account of $750,000 or $1,000,000. You might want to pick up a fun hobby known for reducing stress, because there are going to be times when your portfolio hits rough spots. But there is good news too. Mathematically, just a 5% return on one million dollars is a gain of $50,000, and the reward for taming the emotional torment is much greater. Sadly, Q1 2025 was a great month to lean on those stress-reducing hobbies because the S&P 500 moved 4.59% lower for the quarter (3). Additionally, the S&P 500 moved 8.66% lower from February 19th, 2025, to the end of Q1 (4). Though the 4.59% has some sting to it, moving down nearly 9% in 40 days undeniably tests the emotional resilience of an investor, and we understand this firsthand. We are excitedly moving forward with this quarterly review to discuss what moved markets, tariffs, and what opportunities may arise.

Without question, Wall Street found it very difficult to plan around the Trump tariff shifts. On January 26th, 2025, President Donald Trump announced a 25% tariff on Columbian imports as President Gustavo Petro attempted to decline inbound Columbian migrants. Petro retaliated with a 25% tariff against United States made imports. Shortly after, Petro begrudgingly received the migrants, and the trade dispute 2 ended, providing our president a quick trade war win. Moore F.S. believes this quick victory would go on to fuel President Trump’s confidence using tariffs as weaponry. On February 1st, 2025, President Trump laid the foundation for a 10% China tariff and 25% tariffs on Canada and Mexico. Just two days later the president would signal a 30 day pause on each of our neighbor’s 25% tariff (5). These back-and-forth movements continued off and on for much of the first quarter, with many tariff strategies subjecting only specific industries, e.g. automakers or steel producers, creating not only volatility in the broad stock market but especially within specific industries caught up in the talks. President Trump has labeled April 2nd, 2025, as “liberation day” signaling a big event. Throughout this back-and-forth, Moore Financial Solutions has made every effort not to be on the “wrong side” of the trade and has remained well rooted within our equity portfolio, when appropriate. We view, as mentioned in previous quarterly reviews, the volatility within the stock market as the “cost” or “price” paid emotionally to be able to receive the effective returns stocks could offer. In greater detail, rather than Moore F.S. attempting to time markets or predict the president’s next move and potentially being wrong, we’ll ride the storm out. Although Moore F.S. does not predict a bear market (described as a move down of 20% in the stock market), we point to the resilience of the stock market, overcoming all 29 previous bear markets and having done so rather quickly, taking an average of only 289 days to recover from the drop (6). Though we can’t rely on past market performance to guarantee its future, we believe this reaffirms our approach to using the stock market for clients with a long enough time horizon and ability to pay the emotional “cost” of seeing a portfolio move lower. Moore F.S. has theorized in past quarterly reviews, with no data to back it up, algorithmic trading (computers buying stocks at a “floor” or low point which might give the market support), and a trend of increasingly younger portfolio managers who have only seen speedy recoveries and long bull market rides might reduce the average bear market duration.

One of the main goals of these reviews is to provide a more detailed analysis of what is happening in global markets. Within Q1 of 2025 the “magnificent 7” stocks (Google/Alphabet, Amazon, Apple, Meta/Facebook, Microsoft, Nvidia, and Tesla) became a lagger of the broad market, the other 493 stocks that make up the S&P 500 for example. In Q1 this “mag 7” collection made up 32% of the S&P 500, up 12.3% from 2015 (8). This crowded trade became a rush for the exit in Q1 2025 as the “mag 7” dropped 16%, while the 493-company counterpart recorded a positive gain of .01% (9). We believe this can be viewed more as a rotational trade with unequally weighted stocks, a net negative to the broad market. Moore F.S. aims to not make this mistake in the future and rebalance into equally weighted indexes when concentrations at the top become elevated. Attempting to soften the blow for some Moore F.S. clients, when appropriate, includes fixed income weightings. We view the 4.24% increase in the iShares 20+ Year Treasury Bond Exchange Traded Fund (TLT) as a promising sign that bonds can provide cushion, as there is a flight to safety out of the equity markets and investors sell stocks and buy bonds. Investors with a reasonably longer time horizon may be able to benefit from this market movement in several ways, including rebalancing from fixed income to the stock market, IRA to Roth IRA conversion, contributing to stocks while at lower levels, and/or increasing the monthly amounts flowing into investment plans. We believe most economic cycles offer opportunities like this to take advantage of fluctuations, and just like you, we’re trying to identify if this is a new business cycle, or a brief passing storm.

The emotional cost of holding stocks feels elevated, and I am right there with you! To move away from the progress we’ve experienced in leading you to your goals is difficult, and as President Trump explains there might be more pain to come. I trade your portfolio carefully and prudently, but this might be one of the harder moments to feel clarity in the global markets. Unlike the movements lower during Covid-19 or the Financial Crisis of 08-09, this whole trade dispute could end today. Moreover, it becomes difficult to make large portfolio movements when President Trump (or other global leaders) could pick up the phone and have a 180-degree policy rotation. The scenario in paragraph one, riding the stock market lower, then selling stocks only to miss the recovery, is a worst-case management strategy and will not occur under my management. Instead, I’d rather take my chances that if the market dips, it can also recover. I encourage you to hold that same calming belief.

Did you know? Moore Financial Solutions offers unique/custom-built insurance solutions. Does anything keep you up at night that we could help fix? If so give us a call and we’ll help find you the best policy rates and options as we shop the open market of providers, all while offering our zero-pressure sales process. This includes Life Insurance, Disability Income Insurance, and Long-Term Care Insurance. Let’s review your policy and search for Moore Solutions today!

1. https://finance.yahoo.com/quote/%5EGSPC/history/

2. https://www.cnbc.com/2024/11/10/trumps-mass-deportation-plan-immigrant-workers-and-economy.html

3. https://www.schwab.com/learn/story/fomc-meeting

4. https://www.schwab.com/learn/story/fomc-meeting

5. https://www.marketwatch.com/investing/fund/tlt

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sale

of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or

tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a

period of declining values. Past performance may not be used to predict future results. Investment advisory services offered by duly registered

individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions

are unaffiliated entities. Licensed Insurance Professional. Insurance product guarantees are backed by the financial strength and claims-paying

ability of the issuing company.